Recognizing the Process Behind an Online Tax Return in Australia and How It Works

Recognizing the Process Behind an Online Tax Return in Australia and How It Works

Blog Article

Navigate Your Online Income Tax Return in Australia: Important Resources and Tips

Browsing the on the internet tax return procedure in Australia requires a clear understanding of your obligations and the resources offered to simplify the experience. Vital papers, such as your Tax File Number and income declarations, must be diligently prepared. Selecting an ideal online system can significantly impact the effectiveness of your declaring process.

Recognizing Tax Obligation Obligations

Comprehending tax obligation obligations is important for companies and individuals operating in Australia. The Australian taxes system is controlled by various laws and regulations that need taxpayers to be mindful of their responsibilities. People have to report their revenue properly, that includes incomes, rental earnings, and investment earnings, and pay tax obligations appropriately. Homeowners should comprehend the distinction in between taxed and non-taxable revenue to guarantee compliance and enhance tax obligation end results.

For businesses, tax obligations include numerous aspects, including the Item and Solutions Tax Obligation (GST), firm tax obligation, and payroll tax obligation. It is important for services to register for an Australian Business Number (ABN) and, if relevant, GST registration. These duties demand meticulous record-keeping and prompt entries of income tax return.

Additionally, taxpayers need to be acquainted with readily available reductions and offsets that can alleviate their tax burden. Looking for advice from tax obligation experts can supply important insights into optimizing tax obligation positions while making certain compliance with the regulation. Generally, a detailed understanding of tax commitments is essential for efficient financial preparation and to stay clear of fines linked with non-compliance in Australia.

Important Files to Prepare

Furthermore, put together any kind of relevant bank statements that reflect interest earnings, in addition to returns statements if you hold shares. If you have other income sources, such as rental residential properties or freelance job, guarantee you have documents of these revenues and any kind of linked expenditures.

Do not neglect to consist of reductions for which you might be qualified. This may include receipts for job-related costs, education and learning expenses, or charitable donations. Lastly, consider any private medical insurance declarations, as these can impact your tax responsibilities. By collecting these necessary papers ahead of time, you will streamline your online income tax return process, decrease mistakes, and take full advantage of possible reimbursements.

Selecting the Right Online Platform

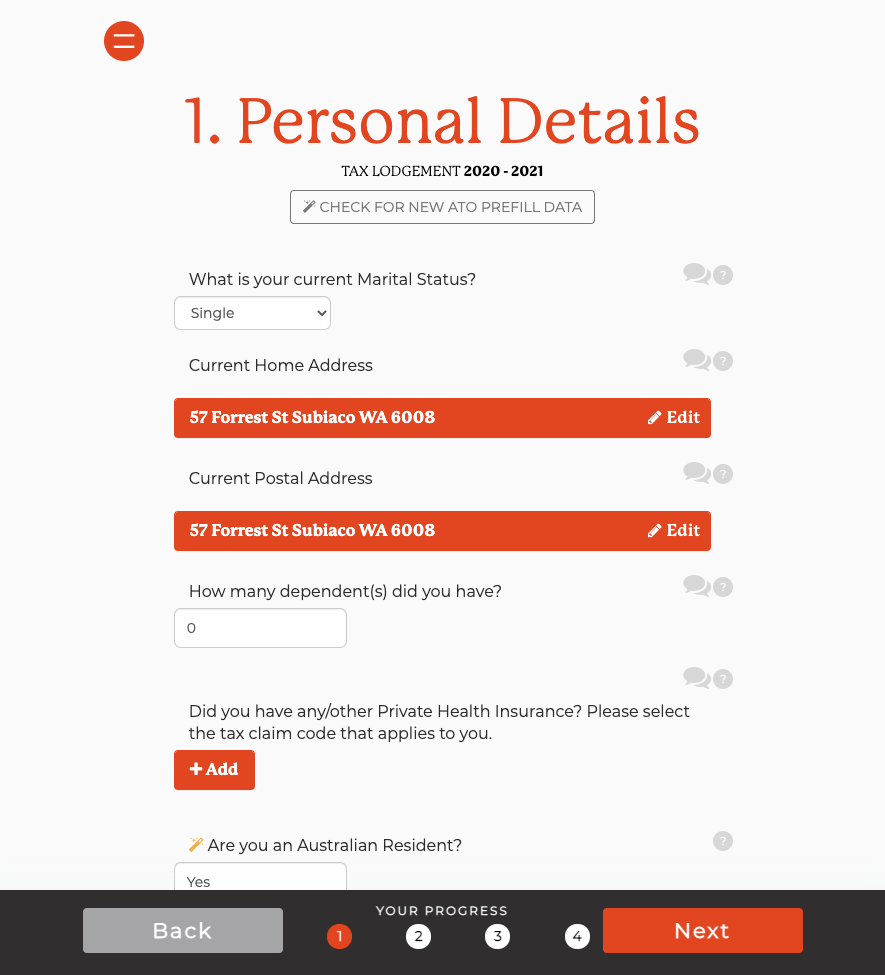

As you prepare to submit your online tax return in Australia, picking the ideal system is necessary to ensure accuracy and convenience of use. A number of vital aspects should assist your decision-making procedure. First, take into consideration the platform's interface. An uncomplicated, intuitive style can significantly improve your experience, making it easier to navigate intricate tax types.

Following, examine the system's compatibility with your financial situation. Some services cater specifically to individuals with basic tax obligation returns, while others give extensive support for extra intricate scenarios, such as self-employment or investment income. Look for platforms that provide real-time mistake monitoring and support, helping to minimize mistakes and guaranteeing conformity with Australian tax obligation laws.

Another vital facet to consider is the level of client support offered. Dependable platforms ought to offer accessibility to help using phone, e-mail, or conversation, especially throughout top declaring durations. Furthermore, research user reviews and ratings to assess the overall satisfaction and reliability of the system.

Tips for a Smooth Filing Process

If you adhere to a few crucial pointers to make sure effectiveness and precision,Submitting your on-line tax obligation return can be a simple procedure - online tax return in Australia. Initially, collect all required documents prior to beginning. This includes your revenue statements, invoices for deductions, and any kind of various other pertinent documents. Having whatever available reduces mistakes and disturbances.

Following, make use of the pre-filling feature supplied by lots of online systems. This can save time and decrease the opportunity of errors by immediately occupying your return with info from previous years and information given by your company and economic establishments.

In addition, verify all entries for precision. online tax return in Australia. Errors can cause postponed reimbursements or problems with the Australian Taxation Office (ATO) Ensure that your individual details, earnings numbers, and reductions are proper

Bear in mind due dates. Filing early not just lowers stress however likewise permits much better planning if you owe taxes. If you have inquiries or uncertainties, seek advice from the help areas of your chosen platform or seek specialist recommendations. By complying with these ideas, you can browse the online tax return process efficiently and with confidence.

Resources for Aid and Support

Browsing the complexities of on-line income tax return can sometimes be overwhelming, however a variety of resources for support and support are readily offered to aid taxpayers. The Australian Taxation Office index (ATO) is the key source of information, supplying extensive overviews on its internet site, consisting of FAQs, training videos, and live chat alternatives for real-time assistance.

Additionally, the ATO's phone support line is readily available for those that prefer direct interaction. online tax return in Australia. Tax specialists, such as licensed tax representatives, can likewise offer customized assistance and guarantee conformity with present tax policies

Verdict

To conclude, properly navigating the online income tax return process in Australia calls for a complete understanding of tax responsibilities, precise preparation of necessary documents, and careful option of an ideal online system. Sticking to useful ideas can improve the filing experience, while available resources use beneficial help. By coming close to the process with persistance and interest to information, taxpayers can make certain compliance and take full advantage of prospective benefits, inevitably adding to a much more efficient and successful tax return outcome.

As you prepare to submit your on the internet tax return in Australia, selecting the ideal platform is crucial to make certain precision and simplicity of usage.In final thought, properly navigating the on-line tax obligation return process in Going Here Australia requires a detailed understanding of tax commitments, precise prep work of important papers, and mindful selection of an ideal online platform.

Report this page